Yangi Zelandiya iqtisodiyoti

Bu maqola ayni damda Furqatlik (munozara) tomonidan faol tahrirlanyapti. Iltimos, mazkur ogohlantirish xabari sahifadan olib tashlanmagunga qadar sahifaga oʻzgartirishlar kiritmay turing. Aks holda, tahrirlar toʻqnashuvi yuz berishi mumkin. Bu sahifa oxirgi marta 04:02, 5-Aprel 2024 (UTC) (9 kun avval) da tahrir qilingan. |

Oklend biznes markazining tungi koʻrinishi | |

| Valyutasi | Yangi Zelandiya dollari (NZD, NZ$) |

|---|---|

| 1 Iyul– 30 Iyun[1] | |

Savdo tashkilotlari |

APEC, JST and OECD |

Mamlakat guruhi |

|

| Statistikalar | |

| Aholi | 5,223,100 kishi (2023-yil iyun oyi holatiga koʻra)[4] |

| YaIM | |

| YaIM darajasi | |

YaIM oʻsishi |

|

Jon boshiga YaIM |

|

Aholi jon boshiga YaIM darajasi |

|

Tarmoqlar boʻyicha YaIM |

|

| |

Qashshoqlik chegarasidan past aholi |

11.0% (nisbiy; 2014)[9] |

| |

Ishchi kuchi |

|

Ishchi kuchi kasb boʻyicha |

|

| Ishsizlik | |

Oʻrtacha yalpi ish haqi |

NZ$5,882 / $3,455.82 oylik[14] (2022) |

| NZ$4,698 / $2,758.99 oylik[15][16] (2022) | |

Asosiy ishlab chiqarish |

Oziq-ovqatni qayta ishlash, Qishloq xoʻjaligi, Oʻrmonchili, Qoʻy yungi, Turizm, Moliyaviy xizmatlar |

| ▬ 1-oʻrin (juda oson, 2020)[17] | |

| Eksport | $72.8 milliard (MY 2022/23)[18] |

Eksport tovarlari |

Sut mahsulotlari, goʻsht, yogʻoch, meva, vino, stanok va boshqa qurilmalar, baliq va dengiz mahsulotlari |

Asosiy eksport hamkorlari |

|

| Import | $88.8 milliard (MY 2022/23)[18] |

Import tovarlari |

Neft, avtomobillar, stanoklar va boshqa qurilmalar, elektronika, tekstil, plastik |

Asosiy import hamkorlari |

|

|

| |

| NZ$156.181 milliard (YaIMning 53%i) (2018-yil dekabr)[19] NZ$86.342 milliard (YaIMning 30.5%i) (2018-yil fevral)[20] | |

| Davlat moliyasi | |

| ▼ YaIMning 31.7%i (2017dan beri)[13] | |

| +1.6% (YaIMning) (2017)[13] | |

| Daromadlar | 74.11 milliard (2017)[13] |

Asosiy maʼlumotlar manbasi: Markaziy razvedka boshqarmasi Jahon faktlar kitobi Barcha qiymatlar, agar boshqacha koʻrsatilmagan boʻlsa, AQSh dollarida keltirilgan. | |

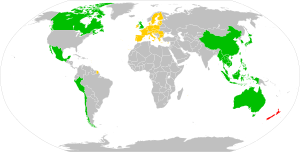

Yangi Zelandiya iqtisodiyoti – erkin bozor tamoyillariga asoslangan yuqori darajada rivojlangan iqtisodiyot[22]. Ushbu iqtisodiyot nominal YaIM boʻyicha jahonda 52- va Xarid Qobiliyati Pariteti indeksiga koʻra 62- eng yirik iqtisodiyotdir. Yangi Zelandiya dunyodagi eng globallashgan va xalqaro savdoga, asosan Xitoy, Avstraliya, Yevropa Ittifoqi, AQSh, va Yaponiya bozorlariga, yuqori darajada integratsiyalashgan iqtisodiyotlaridan biriga ega. Yangi Zelandiyaning Avstraliya bilan 1983-yilgi Yaqin Iqtisodiy Hamkorlik shartnomasi uning Avstraliya iqtisodiyoti bilan yaqin bogʻlanganini koʻrsatadi.

Yangi Zelandiyaning iqtisodiyoti rasmiy va norasmiy tashkilotlardan iborat boʻlib, ushbu tashkilotlar davlat va xususiy sektorga boʻlingan. Iqtisodiyot kuchli xizmat koʻrsatish sektoriga ega. 2013-yilgi jami YaIMning 63%i ushbu sektor hissasiga toʻgʻri kelgan[23]. Yirik orol davlat sifatida bir talay tabiiy resurslar va mineral boyliklarga egalik qiladi[24]. Sanoatning muhim ishlab chiqarish yoʻnalishlariga alyumin ishlab chiqarish, oziq-ovqatni qayta ishlash, metal ishlab chiqarish, hamda yogʻoch va qogʻoz sanoatlari kiradi. Konchilik, ishlab chiqarish, elektr energiya, gaz, suv, va chiqindilarni qayta ishlash YaIMning 16.5%ini tashkil etadi[23]. Birlamchi sektor Yangi Zelandiya eksportining YaIMning 6.5%ini tashkil etsa-da, hali ham eksport hissasida yetakchilikni saqlab qolmoqda[23]. Axborot texnologiyalari sektori esa tezlik bilan oʻsib bormoqda[25].

Yangi Zelandiyaning asosiy kapital bozori Yangi Zelandiya Exchange (NZX) boʻlib, NZXning umumiy bozor kapitallashuvi $226 milliardga baholanadi[26]. Yangi Zelandiyaning pul birligi Yangi Zelandiya dollari (norasmiy nomi „Kivi dollari“) Tinch okeanining toʻrtta hududida amal qiladi. Yangi Zelandiya dollari jahon savdosida eng koʻp foydalaniladigan 10-raqamli valyutadir[27].

Tarixi[tahrir | manbasini tahrirlash]

Koʻp yillar davomida Yangi Zelandiya iqtisodiyoti qishloq xoʻjaligining yung, goʻsht, va sut mahsulotalari ishlab chiqarish kabi tor sohalariga ixtisoslashgan edi. 1850-yillardan to 1970-yillargacha ushbu mahsulotlar Yangi Zelandiyaning eng qimmatli eksport tovarlari boʻlib, Yangi Zelandiyaning iqtisodiy muvaffaqiyatini belgilab bergan[28]. Misol uchun, 1920-yildan 1930-yilning oxirlarigacha, sut mahsulotlarining eksport kvotasi jami eksportning odatda 35%ini egallagan va baʻzi yillari esa bu koʻrsatkich 45%gacha ham yetib borgan[29]. Ushbu mahsulotlarga nisbatan talabning yuqoriligi 1951-yilgi iqtisodiy portlashda oʻzini aksini topgan. Bu paytda Yangi Zelandiya oʻtgan 70 yil davomidagi dunyoning eng yuqori yashash standartlariga ega boʻldi[30].

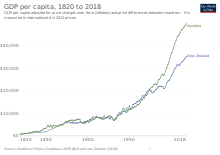

1960-yillarda ushbu tovarlar narxi qulay boshladi, va 1973-yilda Birlashgan Qirollikning Yevropa iqtisodiy hamjamiyatiga qoʻshilishi Yangi Zelandiyaning Qirollik bilan imtiyozli savdo shartnomasining tugatilishiga olib keldi. Bu ham 1970-yildan 1990-yilgacha Yangi Zelandiyaning kishi boshiga YaIM(moslangan Xarid Qobiliyati Pariteti boʻyich)i OECDning oʻrtacha koʻrsatchkichining 115%idan 80%igacha qulashiga qisman sabab boʻlgan[31].

1984- va 1993-yillar oraligʻida Yangi Zelandiya nisbatan yopiq va markazlashgan iqtisodiyotdan OECD tarkibidagi eng ochiq iqtisodiyotga aylandi[32]. Koʻpincha Yangi Zelandiyada Rogernomics deb ataladigan ushbu jarayonda keyingi hukumatlar iqtidisodiyotni liberallashtirishga qaratilgan davlat siyosatini amalga oshirdi.

2005-yil Jahon Banki Yangi Zelandiyani dunyodagi biznes yuritish uchun eng qulay davlat deb atagan[33][34]. Iqtisodiyot diversifikatsiyalashdi va 2008-yilga qadar turizm mamlakatning eng asosiy va katta valyuta yaratadigan sohasiga aylandi[35].

Dastlabki yillar[tahrir | manbasini tahrirlash]

Yangi Zelandiyaning yevropaliklar tomonidan koloniyallashtirilishiga qadar Maori xalqi natural xoʻjalikka asoslangan iqtisodiyotga ega edi, ushbu iqtisodiyot hapū kabi sodda birliklardan iborat boʻlgan[36]. 1790-yillardan boshlab ingliz, fransuz, amerikaliklarning kit va tulen ovlovchi hamda savdo kemalari Yangi Zelandiya suvlariga kela boshladi. Ularning ekipaji miltiq va metall buyumlar kabi yevropa mahsulotlarini Maorilarga oziq-ovqat, yogʻoch, zigʻir uchun ayirboshlagan[37]. Yevropaliklarning oʻsayotgan qonunsizligi va Yangi Zelandiya Company tomonidan Yangi Zelandiyani qonuniy koloniyaga aylantirish rejalari 1840-yilda Yangi Zelandiyani rasman koloniyaga aylantirishni koʻzda tutgan Waitangi Shartnomasini imzolanishiga olib kelgan ikki asosiy faktor edi. Koʻchmanichilar 1860-yillargacha oziq-ovqat uchun maorilarga bogʻliq boʻlgan[36][37]. Undan buyogʻiga immigrantlar fermerlik orqali oʻz-oʻzini taʼminlay oladigan darajaga yetdi va oltin kabi turli xil mineral boyliklarni qazib olishni boshladi. Koʻchmanchilarning manzilgohlari ushbu resurlarning qazib olish hududlarida atroflarida gullab-yashnadi. 1880-yillardagi oltin vasvasasi tufayli oqib kelgan sarmoyalar Dunedinni Yangi Zelandiyadagi eng boy shaharga aylantirdi[38].

Qoʻychilik fermalari Wairarapa hududida birinchi shakllandi va tez orada Southlandning sharqiy qirgʻoqidan to East Capega qadar tarqaldi va bu hodisa oddiy yoʻllar va transportning paydo boʻlishiga olib keldi. Fermerlik uchun yerlarning katta qismi esa maorilardan olingan edi. Qoʻylar soni juda tez oʻsdi va 1850-yillarning oʻrtalariga kelib Yangi Zelandiyada allaqachon bir million qoʻy mavjud edi, bu raqam 1870-yillarning boshiga kelib naqd 10 millionga yetdi[28]. Dastlab Vellington manzilgohidan eksport qilingan yung esa 1850-yillargacha eng katta eksport tovariga aylandi. Muzlatilinmagan goʻsht va sut mahsulotlari eng uzogʻi Avstraliyagacha eksport qilingan[28].

1870-yillarda Julius Vogel koloniyaning ham gʻaznachisi ham bosh vaziri edi. U Yangi Zelandiyani Janub Britaniyasi sifatida tasvirlagan[39] va yoʻl, temir yoʻl, telegraf va koʻpriklar infratuzilmasini rivojlantirishga davlat hisobidan katta sarmoyalar kiritishni boshladi[40]. Bunday oʻsish City of Glasgow Bank bankining 1878-yilda qulaganidan keyin sekinladi, bu esa oʻsha vaqtdagi dunyoning moliyaviy poytaxti boʻlgan Londondan kreditlar olinishiga olib keldi. Iqtisodiy faoliyat bundan keyingi yillarda ancha pasaydi, bu jarayon 1882-yilda muzlatgichning ixtiro qilinishiga qadar davom etdi[30]. Bu ixtiro Yangi Zelandiyaga goʻsht va boshqa muzlatilgan mahsulotlarni Birlashgan Qirollikkacha eksport qilish imkonini berdi. Muzlatgich texnologiyasi iqtisodiyotni rivojlanish yoʻlini belgilab bergan boʻlsada, bu Yangi Zelandiyaning iqtisodiy jihatdan Britaniyaga bogʻliq qilib qoʻydi.

Muzlatgich texnologiyasining muvaffaqiyati mamlakatdagi fermerlikning oʻzishiga hamda rivojlanishiga toʻgʻridan-toʻgʻri sababchi edi. XIX asrda iqtisodiy faoliyat asosan Yangi Zelandiyaning Janubiy Orolida sodir boʻlardi. 1900-yillardan boshlab qoʻychilikka noqulay boʻlgan Shimoliy, Waikato va Taranaki orollarida ham sutchilik fermerligi shakllana boshladi. Sutchilik rivojlangani sari Shimoliy Orol ham iqtisodiyotning muhim qismiga aylanib bordi[41]. Orollardagi yer ishlovi va fermerlikning oʻsishi natijasida Britaniya goʻsht va boshqa hayvon mahsulotlari uchun yagona bozorga aylandi. Sutchilik fermerligining shakllanishi Yevropadagi kuchli bozor talabiga javob sifatida koʻrish mumkin[42]. Bu esa nafaqat Yangi Zelandiya qishloq xoʻjaligini, iqtisodini, va ishlab chiqarish texnikalarini keskin oʻzgartirdi, balki sut mahsulotlari ishlab chiqarish uchun zarur boʻlgan mehnat migratsiyasiga ham olib kedli[42].

XX asr[tahrir | manbasini tahrirlash]

1934-yil 1-avgust kuni Yangi Zelandiya Rezerv Banki Yangi Zelandiyaning markaziy banki sifatida tashkil etildi. Yangi Zelandiya valyuta siyosati Birlashgan Qirollik toominidan belgilanishiga qadar, Yangi Zelandiya funti xususiy banklar tomonidan muomalaga chiqarilgan. Mustaqil markaziy bank Yangi Zelandiya hukumatiga birinchi marta valyuta siyosati ustidan nazoratni berdi[43]. Yangi Zelandiya 1967-yil Yangi Zelandiya dollarini muomalaga kiritishiga qadar valyutasi sterling hududi ichida edi va bu esa Yangi Zelandiya funtini Britaniya funt sterlinggiga bogʻlaganligini anglatardi[44]. 1967-yilda Yangi Zelandiya dollarining muomalaga kiritildi va uning qiymati AQSh dollariga bogʻlandi[44].

XX asrning oʻrtalariga kelib chorvachilik mahsulotlari Yangi Zelandiya eksportining 90%idan koʻpini tashkil etgan[41] va 1950-yillarda ushbu eksportning 65%i Britaniya bozoriga ketardi. Kafolatlangan narxlar va ishonchli bozor Yangi Zelandiyaning boshqa davlatlardan import mahsulotlariga yuqori tariflar qoʻyishiga olib keldi. Kuchli import nazorati mahalliy ishlab chiqaruvchilarga oʻxshash mahsulotlarni mahalliy darajada ishlab chiqarish imkonini berdi, natijada Yangi Zelandiyada mavjud boʻsh ish oʻrinlari bazasini kengaydi va bir vaqtning oʻzida chet-elning yuqori narxdagi tovarlari bilan raqobatlashishini taʼminaldi.

Bu farovonlik darajasi 1955-yilda Britaniyaning Yangi Zelandiya eksportiga nisbatan kafolatli narxlar siyosatini toʻxtatishiga qadar davom etdi[45]. Bundan buyogʻiga Yangi Zelandiya eksport daromadini erkin bozor belgilay boshladi. 1950- va 1960-yillar davomida eksport sektori endi Yangi Zelandiyaning oʻsib borayotgan istemolchilik madaniyati talab qilayotgan import darajasini qoplay olmasdi, va natijada mamlakatning yashash standartlari pasayishni boshladi.

Britaniya 1961-yilda Yevropa Iqtisodiy Hamjamiyatiga qoʻshilish uchun ariza topshiradi, ammo arizaga Fransiya tomonidan veto beriladi. Keith Holyoake hukumati bunga Yangi Zelandiya eksport bozorlarini diversifikatsiyalash harakatlari orqali javob beradi. 1965-yilda erkin savdo shartnomasi (Avstraliya Yangi Zelandiya Erkin Savdo Shartnomasi)ni imzolashi,[46] va Gong Kong, Jakarta, Saygon, Los-Anjeles and San Francisco shaharlarida yangi diplomatik vakolatxonalarni ochishi ushbu harakatlardan bir qismidir[29]. 1967-yilda Britaniya YIIga kirish uchun yana ariza topshiradi, va 1970-yilda aʻzolik shartlari boʻyichaa muzokaraga kirishadi. Holyoakening oʻrinbosari Jack Marshall (1972-yil vaqtinchalik Bosh Vazir boʻlgan) Yangi Zelandiya eksport tovarlarining Birlashgan Qirollikka davomiy kirishini nazarda tutgan „Lyuksemburg Shartnomasi“ni imzolashga erishadi.[47]

1973-yil 1-yanvarda Britaniya YIIga toʻliq aʻzolikni qoʻlga kiritadi, va Lyuksemburg Shartnomasidan tashqari Yangi Zelandiya bilan tuzilgan hamma savdo shartnomalarini tugatadi[47]. Ushbu yilning oxiriga kelib Yangi Zelandiyaning faqatgina 26.8% eksporti Britaniya hissasiga toʻgʻri keladi[48]. Bu esa yashash standartlariga katta taʻsir koʻrsatadi. 1953-yilda Yangi Zelandiya dunyodagi eng yuqori uchinchi yashash standartiga ega davlat edi. 1978-yilga kelib bu koʻrsatkich 22-oʻringa tushib ketadi[45].

Oʻzining doimiy bozoriga cheklanmagan kirish huquqidan ayrilgan Yangi Zelandiya muqobil eksport bozorlarini qidirishni va iqtisodiyotni diversifikatsiyalashni davom ettirdi. Marshallni oʻrnini egallagan Norman Kirk hukumati who succeeded Marshall, put greater emphasis on expanding Yangi Zelandiya tashqi savdosini kengaytirishga yanada katta urgʻu bera boshladi, ayniqsa Janubi-sharqiy Osiyo bilan. 1973-yil oktyabrdagi Arab-Isroil urushi oʻlaroq Yaqin Sharqlik neft ekportchilari neft embargosini eʻlon qiladi. Bu esa 1973-yilgi neft inqiroziga sabab boʻladi va Yangi Zelandiyaning achinarli ahvoldagi iqtisodiy holatini yanada yomonlashtirdi. Transport va import mahsulotlari narxining keskin koʻtarilishi inflatsiyani juda ham oʻstirib yubordi, bu esa yashash standartlarining qulashiga olib keldi[49].

Think Big[tahrir | manbasini tahrirlash]

Erondagi Islom Inqilobi natijasida yuzaga kelgan 1979-yilgi energiya inqirozi oʻsha davrda(1975-va1984-)gi mamlakatning bosh vaziri Robert Muldoon Think Big nomli iqtisodiy strategiyasini joriy etadi. Yangi Zelandiyaning boy tabiiy gazi uchun yirik hajmdagi sanoat zavodlari quriladi. Eksport uchun yangi turdagi mahsulotlar paydo boʻladi, jumladan ammiak, karbamid oʻgʻitlari, metanol va benzin ishlab chiqarildi. Yangi Zelandiyaning neft importiga qaramligini oldini olish uchun yuqoridagi islohotlar amalga oshirildi va bu maqsad yoʻlida elektrdan foydlanish kengaytirildi[35]. Misol uchun shu maqsad yoʻlida Yangi Zelandiyaning North Island Main Trunk temir yoʻli elektrlashtirildi[35].

Boshqa shunday loyihalarga elektrga boʻlgan oʻsib borayotgan talabni qondirish uchun Clutha daryosida Clyde toʻgʻoni qurildi va ishlab chiqarilgan elektr Glenbrookdagi kengayotgan New Zealand Steel zavodiga ham yoʻnaltirila boshlandi[50].

1971-yilda ochilgan Tiwai Point Aluminium Smelter alyumin eritish zavodi Think Big strategiyasi doirasida yangilangan va har yili taxminan NZ$1 milliardlik eksport amalga oshirgan[51].

Afsuski bu loyihalarning aksariyati 1980-yillardagi neft narxlarining tushishi fonida ishga tushiriladi. Xom neftning narxi barreliga 1980-yildagi AQSh$90dan bir necha yil ichida AQSh$30gacha tushib ketdi. Davlat hisobiga olingan qarzlar tufayli ishga tushirilgan ushbu loyihalar davlat qarzini 1975-yil Muldoon bosh vazirlikka $4.2 milliarddan 9 yildan soʻngi $21.9 milliardgacha oshirib yuborgan. Inflatsiya yuqoriligacha qolaverdi. 1980-yillarda oʻrtacha inflatsiya 11%ni tashkil etdi[49]. Ishchilar Partiyasi 1984-yili hukumatga kelganda davlat aktivlarining keng koʻlamli sotish kompaniyasining bir qismi oʻlaroq ushbu loyihalarning aksariyati xususiy sektorga sotib yuboriladi[50]

Ammo Muldoon hukumati deregulyatsiya yoʻlida bir necha qadamlar qoʻygan edi. Misol uchun 1982-yilda hukumat yuklarni 150 kmdan ortiq masofaga tashiydigan avtotashuvchilar uchun transportni litsenziyash cheklovlarini olib tashladi[52].

Rogernomics[tahrir | manbasini tahrirlash]

1984-iyulda saylangan Ishchilar Partiyasi hukumati iqtisodiyotga davlatning aralashuvini cheklab erkin bozor tomoyillari bozorni boshqarishiga yoʻl ochib berdi. Ushbu islohotlar keyinchalik „Rogernomics“ nomi bilan tanildi. Rogernomics atamasi 1984-yildan to 1988-gacha moliya vaziri boʻlgan Roger Douglas sharafiga qoʻyilgan. Islohotlar markaziy bankni siyosiy qarorlardan mustaqil qilish, yuqori lavozimli davlat xizmatchilari uchun ish shartnomalari, davlat sektori moliyasini isloh qilish, soliq betarafligi, subsidiyadan holi qishloq xoʻjaligi, va raqobatli sektorda betaraf boʻlishni oʻz ichiga oladi. Hukumat subsidiyalari jumladan qishloq xoʻjaligi uchun subsidiyalar bekor qilindi, import cheklovlari yengillashtirildi, valyuta kursi erkinlashtirildi, davlatning markaziy bank foiz stavkasi, maoshlar, va narxlar ustidan nazorati bekor qilindi, va individual soliq toʻlovchilar uchun soliq yuki qisqartirildi. Qattiq valyuta siyosati va hukumatning budjet defitsitini qisqartirish uchun qilingan katta qadamlar 1987-yilgi 18%dan yuqori inflatsiyani tushirgan. Davlat egalik qiladigan korxonalarni 1980- va 1990-yillardagi deregulatsiyalash davlatning iqtisodiyot rolini kamaytirdi va davlat qarzlarining bir qismini toʻlab boʻlinishiga olib keldi.

The new Government was faced with an exchange rate crisis the day after it was elected. Speculators expected the change of government to result in a 20% devaluation of the Yangi Zelandiya dollar, which led to the 1984 Yangi Zelandiya constitutional crisis due to Muldoonʻs refusal to devalue, worsening the currency crisis further. As a result, the dollar was floated on 4 March 1985, allowing for the value of the dollar to change with the market.[53] Prior to the dollar being floated, the dollar was pegged against a basket of currencies.[53]

Financial markets were deregulated and tariffs on imported goods lowered and phased out. At the same time subsidies to many industries, notably agriculture, were removed or significantly reduced. Income and company taxes were reduced and the top marginal tax rate was reduced from 66% to 33%. These were replaced by a comprehensive tax on goods and services (GST) initially set at 10%, then increased to 12.5% in 1989 and to 15% in 2010. A surtax on universal superannuation was also introduced.[37] Many government departments were corporatised, and from 1 April 1987 became State owned enterprises, required to make a profit. The new corporations shed thousands of jobs adding to unemployment; Electricity Corporation 3,000; Coal Corporation 4,000; Forestry Corporation 5,000; Yangi Zelandiya Post 8,000.[54]

The wage and price freeze of the early eighties coupled with the removal of financial restrictions and a lack of investment opportunities, led to a speculative bubble on Yangi Zelandiyaʻs sharemarket, sharemarket crash of 1987, in which Yangi Zelandiyaʻs sharemarket shed 60% from its 1987 peak, and taking several years to recover.[55][56]

Inflation continued to be a major problem afflicting the Yangi Zelandiya Iqtisodiyot. Between 1985 and 1992, inflation averaged 9% per year and the Iqtisodiyot was in recession.[57] The unemployment rate rose from 3.6% to 11%,[58] Yangi Zelandiyaʻs credit rating dropped twice, and foreign debt quadrupled.[57] In 1989 the Reserve Bank Act 1989 was passed, creating strict monetary policy under the sole control of the Reserve Bank Governor. From then on the Reserve Bank focused on keeping inflation low and stable, using the Official Cash Rate (OCR) – the price of borrowing money in Yangi Zelandiya – as its primary means to do so. As a result, inflation rates fell to an average of 2.5% in the 1990s, compared to 12% in the 1970s.[49] However, the tightening of monetary policy contributed to rising unemployment in the early 1990s.[59]

The Labour Party was greatly divided over Rogernomics, especially following the 1987 sharemarket crash and its effect on the Iqtisodiyot, which slumped along with the rest of the world into recession in the early 1990s. The National Party was returned to power at the 1990 general election and Ruth Richardson became minister of finance under Prime Minister Jim Bolger. The new Government was again thrown a major economic challenge, with the then state-owned Bank of Yangi Zelandiya needing a bail-out to stay operational.

Richardsonʻs first budget in 1991, nicknamed the ʻMother of all Budgetsʻ,[60] attempted to address constant fiscal deficits and borrowing by cutting state spending. Unemployment and social welfare benefits were cut and ʻmarket rentsʻ were introduced for state houses – in some cases tripling the rents of low-income people.[61] Richardson also introduced user-pays requirements in hospitals and schools.[60] These reforms became known derisively as Ruthanasia.

By this time, Yangi Zelandiyaʻs Iqtisodiyot faced serious social problems; the number of Yangi Zelandiyaers estimated to be living in poverty grew by at least 35% between 1989 and 1992;[57] many of the promised economic benefits of the experiment never materialised.[62] Gross domestic product per capita stagnated between 1986–87 and 1993–94, and by March 1992 unemployment rose to 11.1%[63] Between 1985 and 1992, Yangi Zelandiyaʻs Iqtisodiyot grew by 4.7% during the same period in which the average OECD nation grew by 28.2%.[64] From 1984 to 1993 inflation averaged 9% per year, Yangi Zelandiyaʻs credit rating dropped twice, and foreign debt quadrupled.[57] Between 1986 and 1993, the unemployment rate rose from 3.6% to 11%.[65]

Deregulation also created a business-friendly regulatory framework which has benefited those able to take advantage of it. A 2008 survey in The Heritage Foundation and The Wall Street Journal ranked Yangi Zelandiya 99.9% in „Business freedom“, and 80% overall in „Economic freedom“, noting that it takes, on average, only 12 days to establish a business in Yangi Zelandiya, compared with a worldwide average of 43 days.[66]

Deregulation has also been blamed for other significant negative effects. One of these was the leaky homes crisis, whereby the loosening up of building standards (in the expectation that market forces would assure quality) led to many thousands of severely deficient buildings, mostly residential homes and apartments, being constructed over a period of a decade. The costs of fixing the damage has been estimated at over NZ$11 billion (as at 2009 holatiga koʻra).[67]

XXI asr[tahrir | manbasini tahrirlash]

Unemployment continued to fall from 1993 to 1994 fiscal year, until the onset of the 1997 Asian financial crisis again pushed the rate higher.[68] By 2016 the unemployment rate decreased to 5.3 percent, the lowest level in 7 years.[69]

Between 2000 and 2007, the Yangi Zelandiya Iqtisodiyot expanded by an average of 3.5% a year driven primarily by private consumption and the buoyant housing market. During this period, inflation averaged only 2.6% a year, within the Reserve Bank’s target range of 1% to 3%.[70] However, in early 2008 the Iqtisodiyot entered recession, before the effects of the global financial crisis (GFC) set in later that year. A drought over the 2007/08 summer led to lower production of dairy products in the first half of 2008. Domestic activity slowed sharply over 2008 as high fuel and food prices dampened domestic consumption, while high interest rates and falling house prices drove a rapid decline in residential investment.[70]

Around the world instability was developing in the finance sector. This reached a peak in September 2008 when Lehman Brothers, a major American bank, collapsed propelling the world into the global financial crisis.[71]

Moliyaviy qulash (2006–2012)[tahrir | manbasini tahrirlash]

Uncertainty began to dominate the global financial and economic environment. Business and consumer confidence in Yangi Zelandiya plummeted as dozens of finance companies collapsed.[72] To try and stop a flight of funds from Yangi Zelandiya institutions to those in Avstraliya, the Government established the Crown Retail Deposit Guarantee Scheme to cover depositors funds in the event that a bank or finance company went broke.[73] This protected some investors but nevertheless, at least 67 finance companies collapsed within a short period of time.[74] The largest of these was South Canterbury Finance which cost taxpayers NZ$1.58 billion when the company collapsed in August 2010.[75] The directors of many of these finance companies were subsequently investigated for fraud and some high-profile directors went to prison.[76][77][78][79][80]

In an attempt to stimulate the Iqtisodiyot, the Reserve Bank lowered the Official Cash Rate (OCR) from a high of 8.25% (July 2008) to an all-time low of 2.5% at the end of April 2009.[70]

Fortunately for Yangi Zelandiya, the recession was relatively shallow compared to many other nations in the OECD, it was sixth least affected out of the 34 member nations with negative real GDP growth totaling 3.5%.[70] In 2009 the Iqtisodiyot picked up, led by strong demand from major trading partners Avstraliya and China, and historically high prices for Yangi Zelandiyaʻs dairy and log exports. In 2010 the GDP grew by a modest 1.6%, but over the next couple of years economic activity continued to improve, driven by the rebuild in Canterbury after the Christchurch earthquakes and recovery in domestic demand.[70] Through 2011, global conditions deteriorated and the terms of trade eased off their 2011 peak, continuing to moderate until September 2012. Since then, commodity prices have rebounded strongly, with strong demand from China and the international situation improving. Commodity prices have been at record highs in recent quarters and remain elevated. High commodity prices are expected to provide a considerable boost to nominal GDP growth in the near term.[70]

"Rock star" iqtisodiyoti[tahrir | manbasini tahrirlash]

In 2013, the Iqtisodiyot grew 3.3%. HSBC chief economist for Avstraliya and Yangi Zelandiya, Paul Bloxham, was so impressed that he predicted Yangi Zelandiyaʻs growth would outpace most of its peers, and he described Yangi Zelandiya as the „rock star Iqtisodiyot of 2014“.[81] Another financial commentator said the Yangi Zelandiya dollar was the „hottest“ currency of 2014.[82] Only three months later, the Yangi Zelandiya Productivity Commission expressed concern about low living standards and problems affecting the long-term drivers of growth. Paul Conway, Director of Economics and Research at the Productivity Commission, wrote: „Yangi Zelandiyaʻs broad policy settings should generate GDP per capita 20 per cent above the OECD average, but the actual result is more than 20 per cent below average. We may be punching above our weight, but thatʻs only because we are in the wrong weight division!“[83] In August, Bloxham admitted that „the sharp decline in dairy prices over the last six months has clouded the outlook somewhat“.[84] In December however Bloxham stated that he thought the Yangi Zelandiya Iqtisodiyot would continue to grow strongly.[85]

In 2014 increased attention was paid to the growing gap between rich and poor. In The Guardian, Max Rashbrook said policies implemented by both Labour and National governments have increased inequality. He claims that for twenty years outrage „has been muted“, but „Alarm bells are finally beginning to sound. Recent polling shows three-quarters of Yangi Zelandiyaers think theirs is no longer an egalitarian country“.[86]

2020–22 yilgi iqtisodiy inqiroz[tahrir | manbasini tahrirlash]

Yangi Zelandiya recorded its first case of COVID-19 on 28 February 2020. In response to the pandemic, the country closed its borders to everyone except Yangi Zelandiya citizens and residents on 19 March, and went into full (Level 4) lockdown from 26 March to 27 April, followed by a partial (Level 3) lockdown from 28 April to 13 May.

The border closure combined with the lockdowns saw the retail, accommodation, hospitality, and transport sectors experiencing major declines. On 17 September 2020, Yangi Zelandiya officially entered a recession, with the country’s gross domestic product retracting by 12.2% in the June quarter.[87][88][89] The GDP rebounded 14% in the September quarter to leave a 2.2% year-on-year retraction.[90]

After successfully containing the virus, the Yangi Zelandiya Iqtisodiyot had sharp growth in what is known as a V-shaped recovery and ended the year with an overall economic expansion of 0.4%, better than the predicted 1.7% contraction.[91] Unemployment also dropped to 4.9% in December 2020, down from a peak Covid effected rate of 5.3% in September.[92]

By 23 September 2021, the Restaurant Associationʻs Chief executive Marisa Bidois estimated that about 1,000 hospitality businesses nationwide had been forced to close as a result of the COVID-19 pandemic, leading to the loss of 13,000 jobs. In response, the Association lobbied the Government for Government for continued wage subsidies and incentives to boost customer rates.[93] On 13 November 2021, the Bay of Plenty Times reported that 26,774 companies had been liquidated during the first eight months of 2021.[94]

On 27 January 2022, Yangi Zelandiyaʻs inflation rate hit a 30-year record high of 5.9% at the end of 2021. According to figures released by Statistics Yangi Zelandiya, the rising cost of construction, petrol and rents pushed the consumer price index up 1.4 per cent between October and December 2021. Statistics NZ also recorded a two percent increase in household utilities expenses, which was fuelled by the rising costs of new dwellings (which rose by 16% from 2020) and a 30 percent hike in fuel prices (from NZ $1.87 per litre to $2.45 per litre). Prime Minister Jacinda Ardern attributed the sharp inflation rate to rising crude oil prices overseas. By contrast, the opposition National Party leader Christopher Luxon and Finance spokesperson Simon Bridges attributed rising inflation to the Governmentʻs alleged „wasteful“ spending.[95]

On 1 February 2022, an annual report released by the Organisation of Economic Cooperation and Development (OECD) identified the country’s border restrictions and declining house prices as the main risks facing Yangi Zelandiyaʻs Iqtisodiyot that year. While the OECD report credited Yangi Zelandiyaʻs elimination strategy and macroeconomic stimuli such as wage and socio-economic subsidies with helping the Iqtisodiyot to bounce back to pre-COVID-19 levels, it also warned that excessive Government spending was causing the Iqtisodiyot to overheat and substantial increases in household and government debt. The OECD welcomed the Reserve Bank’s decision to raise interest rates but also urged the Government to raise the superannuation age, eliminate obstacles to building houses, and reduce government spending. The OECD also supported the introduction of a social insurance scheme for unemployed workers.[96]

Umumiy koʻrinishi[tahrir | manbasini tahrirlash]

In 2015 the Social Progress Index, which covers such areas as basic human needs, foundations of well-being, and the level of opportunity available to citizens, ranked the Yangi Zelandiya Iqtisodiyot fifth.[97] However, the outlook includes some challenges. Yangi Zelandiya income levels, which used to be above those of many countries in Western Europe prior to the crisis of the 1970s, dropped in relative terms and never recovered. As a result, the number of Yangi Zelandiyaers living in poverty has grown and income inequality has increased dramatically.

Yangi Zelandiya has also had persistent current-account deficits since the early 1970s, peaking at −7.8% of GDP in 2006 but falling to −2.6% of GDP in FY 2014.[98] The CIA World Fact Book estimates Yangi Zelandiyaʻs 2017 public debt (that owed by the government) at 31.7% of GDP.[99] Between 1984 and 2006, net external foreign debt increased 11-fold, to NZ$182 billion.[33] -, 2018-yil holatiga koʻra gross core crown debt was NZ$84,524 million or 29.5% of GDP and net core crown debt was NZ$62,114 million or 21.7% of GDP.[20]

Despite Yangi Zelandiyaʻs persistent current-account deficits, the balance on external goods and services has generally been positive. In FY 2014, export receipts exceeded imports by NZ$3.9 billion.[98] There has been an investment income imbalance or net outflow for debt-servicing of external loans. In FY 2014, Yangi Zelandiyaʻs investment income from the rest of the world was NZ$7 billion, versus outgoings of NZ$16.3 billion, a deficit of NZ$9.3 billion.[98] The proportion of the current-account deficit that is attributable to the investment income imbalance (a net outflow to the Avstraliyan-owned banking sector) grew from one third in 1997 to roughly 70% in 2008.[100]

Soliqqa tortish[tahrir | manbasini tahrirlash]

At the national level the Inland Revenue Department (IRD) collects tax in Yangi Zelandiya on behalf of the Yangi Zelandiya Government. Yangi Zelandiyaers pay national taxes on personal and business income, and on the supply of goods and services (GST). There is no capital-gains tax, although certain „gains“ such as profits on the sale of patent rights are deemed to be income. Income tax does apply to property transactions in certain circumstances, particularly speculation. Local authorities manage and collect local property taxes (rates). Some goods and services carry a specific tax, referred to as an excise or a duty such as alcohol excise or gaming duty. These are collected by a range of government agencies such as the Yangi Zelandiya Customs Service. There is no social security (payroll) tax or land tax in Yangi Zelandiya.

The 2010 Yangi Zelandiya budget announced cuts to personal tax-rates, with the top personal tax-rate reduced from 38% to 33%[101] The cuts gave Yangi Zelandiya the second-lowest personal tax burden in the OECD. Only Mexicoʻs citizens retained a higher percentage-wise „take home“ proportion of their salaries.[102]

The cuts in income tax were estimated to reduce revenue by $2.46 billion.[103] To compensate, the National government raised GST from 12.5% to 15%.[104] Treasury figures show that top income-earners in Yangi Zelandiya pay between 6% and 8% of their income on GST. Those at the bottom end, earning less than $356 a week, spend between 11% and 14% on GST. Based on these figures, The Yangi Zelandiya Herald predicted that putting GST up to 15% would increase living costs for the poor more than twice as much as for the rich.[105]

Korrupsiya[tahrir | manbasini tahrirlash]

Yangi Zelandiya 2017-yilda Transparency International korrupsiya darajasi indeksida (CPI) 100 balldan 89 ball bilan 1-o‘rinni egallagan[106]. 2018-yilda esa Yangi Zelandiya korrupsiyani qabul qilish indeksida 100 balldan 87 ball bilan 2-o‘rinni egallagan[107]. 2019-yil korrupsiyani idrok etish indeksida 100 balldan 87 ball bilan 1-oʻrinni egallagan[108]. Yangi Zelandiya dunyodagi eng kam korrupsiyalashgan davlatlardan biri boʻlsa-da, Yangi Zelandiyada haligacha korrupsiya mavjud[109].

Hududiy iqtisodiyotlar[tahrir | manbasini tahrirlash]

2023-yil mart oyida Yangi Zelandiya Statistika Agentligi 2022-yil mart oyida yakunlangan yil uchun Yangi Zelandiya viloyatlari kesimida yalpi ichki mahsulot taqsimoti tafsilotlarini eʼlon qildi:[110]

| Hudud (map reference) | YaIM, 2021 (NZ$ million) | Milliy YaIMdagi ulushi | Kishi boshiga YaIM 2021 (NZ$) | GDP growth, 2020-21 |

|---|---|---|---|---|

| Northland (1) | 9,321 | 2.6% | 46,611 | Andoza:Fluc% |

| Auckland (2) | 136,493 | 37.8% | 80,328 | Andoza:Fluc% |

| Waikato (3) | 32,558 | 9.0% | 63,713 | Andoza:Fluc% |

| Bay of Plenty (4) | 21,666 | 6.0% | 62,673 | Andoza:Fluc% |

| Gisborne (5) | 2,690 | 0.7% | 51,833 | Andoza:Fluc% |

| Hawkeʻs Bay (6) | 10,708 | 3.0% | 58,769 | Andoza:Fluc% |

| Taranaki (7) | 9,599 | 2.7% | 75,643 | Andoza:Fluc% |

| Manawatū-Whanganui (8) | 14,328 | 4.0% | 55,665 | Andoza:Fluc% |

| Wellington (9) | 44,987 | 12.5% | 82,772 | Andoza:Fluc% |

| Shimoliy orol | 282,355 | 78.1% | 72,068 | Andoza:Fluc% |

| Tasman / Nelson (10 / 11)[* 1] | 6,614 | 1.8% | 58,580 | Andoza:Fluc% |

| Marlborough (12) | 3,466 | 1.0% | 67,045 | Andoza:Fluc% |

| West Coast (13) | 2,101 | 0.6% | 64,063 | Andoza:Fluc% |

| Canterbury (14)[* 2] | 44,032 | 12.2% | 67,400 | Andoza:Fluc% |

| Otago (15) | 15,336 | 4.2% | 62,518 | Andoza:Fluc% |

| Southland (16) | 7,396 | 2.0% | 72,223 | Andoza:Fluc% |

| South Island | 78,945 | 21.9% | 65,875 | Andoza:Fluc% |

| Yangi Zelandiya | 361,299 | 100.0% | 70,617 | Andoza:Fluc% |

- ↑ Nelson and Tasman are combined by Statistics New Zealand, but are separate regions.

- ↑ Includes the Chatham Islands.

Ishsizlik[tahrir | manbasini tahrirlash]

1973-yilda Britaniyaning YIIga kirishi Britaniyani Yangi Zelandiyaning eng asosiy eksport bozori sifatida oʻrnini yoʻqotadi[111]. Ushbu iqtisodiy shokdan avval Yangi Zelandiyada ishsizlik juda past edi. 1966-yildagi iqtisodiy inqiroza va jun narxlarining pasayishi jun bozorida ishsizlikning 131%ga oʻsishiga olib keladi, ammo umumiy ishsizlik darajasi atigi 0,7%ga oshgan[112].

1973-yildan keyin Yangi Zelandiyada ishsizlik doimiy iqtisodiy va ijtimoiy muammoga aylandi. 1976-yildan 1978-yillar hamda 1982-yildan 1983-yillar davomidagi iqtisodiy inqirozlar yana ishsizlikni sezilarli darajada oshirdi[112]. 1985-2012-yillar oraligʻida ishsizlik darajasi oʻrtacha 6,29%ni tashkil etgan. 1987-yilgi fond bozori qulashidan soʻng ishsizlik naqd 170%ga oʻsgan[112] va 1991-yil sentyabr oyida bu koʻrsatkich11,20%ni tashkil etgan[113]. 1997-yildagi Osiyo moliyaviy inqirozi ishsizlikni yana 28%ga koʻtaradi[112]. 2007-yilga kelib ishsizlik yana pasaya boshlaydi va bu koʻrsatkich 3,5% (2007-yil dekabr)ni tashkil etadi. Bu 1986-yilda amaldagi ishsizlikni tadqiq qilish usuli boshlanganidan beri eng past koʻrsatkichdir. Ishsizlik darajasi boʻyicha mamlakat OECD aʻzolari orasidagi 5-oʻrinni egallaydi (OECD oʻrtacha koʻrsatkichi bu vaqtda 5,5% edi). Koʻrsatkichlarning pastligi kuchli iqtisodiyot va barcha darajalardagi ish oʻrinlarining kengligi bilan uzviy bogʻliqdir[114]. Ishsizlik darajasini OECD davlatlari bilan doimo toʻgʻridan-toʻgʻri taqqoslab boʻlmaydi, chunki aʻzolarning hammasi ham mehnat bozori statistikasini bir xilda yuritmaydi.

Soʻnggi yillarda band boʻlgan aholining ulushi ham oʻsib, barcha aholining 68,8 foizini tashkil etdi, toʻliq kunlik ish joylari biroz oshgan va toʻliq boʻlmagan ish vaqti oʻz navbatida kamaygan. Mehnatga layoqatli aholi ulushining oʻsishi ish haqini oshirish va koʻproq odamlarni ish bilan taʻminlash uchun yashash xarajatlarini oshishiga olib kelgan[114]. Ishsizlikning pastligi ham kamchiliklarga ega edi. Ulardan bir koʻplab kompaniyalar ish oʻrinlarini toʻldirishga qodir emasligidir.

2007-yil dekabr oyidan boshlab ishsizlik soni asosan jahon moliyaviy inqirozi sabab oʻsishni boshladi. Bu tendensiya 2012-yilning sentyabrigacha davom etib, 6,7%ga yetadi. Shu vaqtdan soʻng past ishsizlik darajasi tiklana boshladi va 2019-yil holatiga koʻra 3,9%gacha tushgan[115].

Uy-joy sotib olish imkoniyati[tahrir | manbasini tahrirlash]

Shamubeel Eaqub, formerly a principal economist at the Yangi Zelandiya Institute of Economic Research (NZIER), said in 2014 that thirty years prior, an average house in Yangi Zelandiya cost two or three times the average household income. House prices rose dramatically in the first years of the 21st century and by 2007, an average house cost more than six times household income.[116] International surveys in 2013 showed that housing was unaffordable in all eight of Yangi Zelandiyaʻs major markets – „unaffordable“ being defined as house prices which are more than three times the median regional income.[117]

Demand for property has been strongest in Auckland. In 2014 the average sales price there went from $619,136 to $696,047, a rise of 12% in that 12-month period alone.[118] In 2015, prices rose another 14%.[119] This made Auckland Yangi Zelandiyaʻs least affordable market and one of the most expensive cities in the world[120] with houses costing 8 times the average income.[117] Between 2012 and April 2016, the average Auckland home increased in price by just over two-thirds reaching $931,000 – higher than the cost of an average home in Sydney.[121]

As a result, more people are being priced out of the property market. Those on low incomes are hardest hit, affecting many Maori and Pasifika. Yangi Zelandiyaʻs relatively high mortgage-rates are exacerbating the problem[122] making it difficult for young people with steady jobs to buy their first home.[123] According to a 2012 submission made to the Housing Affordability Inquiry,[124] escalating house prices are also impacting on many middle income groups, especially those with large families.[125] Mortgage adviser Bruce Patten said the trend was „disturbing“ and added to the gap between the „haves and have-nots“.[126]

Property-analysis company CoreLogic saidAndoza:When that 45% of house purchases in Yangi Zelandiya are now made by investors who already own a home, while another 28% are made by people moving from one property to another. Approximately 8% of purchases go to overseas-based cash buyers[116] – primarily Avstraliyans, Chinese, and British – although mostAndoza:Quantify economists believe that foreign investment is currentlyAndoza:When too small to have a significant effect on property prices.[127]

Whether purchases are made by Yangi Zelandiyaers or by foreigners, it is generally those who are already well off who are buying the bulk of properties on the market. This has had a dramatic effect on home-ownership rates by Kiwis, nowAndoza:When at its lowest level since 1951. Even as recently as 1991, 76% of Yangi Zelandiya homes were occupied by their owners. By 2013, this had reduced to 63%,[128] indicating that more and more people are having to rent.[manba kerak] Raewyn Cox, chief executive of the Federation of Family Budgeting, says: „High prices and high interest rates (have) sentenced a rising number of Yangi Zelandiyaers to be lifetime tenants“ where they are „stuck in expensive rental situations, heading towards retirement.“[122]

Tengsizlik[tahrir | manbasini tahrirlash]

1982- va 2011-yillar oralgʻida Yangi Zelandiyaning yalpi ichki mahsuloti 35%ga oʻsgan. Iqtisodiy oʻsishning deyarli yarmi mamlakatdagi allaqachon juda ham boy boʻlgan kichik guruhi hissasiga toʻgʻri kelgan. Bu vaqt davomida eng boy 10% aholi($72,000dan koʻp pul qopadigan)ning daromadi[129] deyarli ikki martaga oʻsib $56,300dan $100,200gacha yetgan. Aholining kambagʻal 10% qismining oʻrtacha daromadi bor yoʻgi 13%ga oʻsib $9,700dan $11,000ga yetgan[130].

Yangi Zelandiya Statistika agentligi P80/20 nisbatidan foydalangan holda daromadlar nomutanosibligini hisoblaydi va ularning tasdiqlashicha Yangi Zelandiyada daromadlar tengsizligi kuchaygan. Bu nisbat yuqori daromadli uy xoʻjaliklari (80 foizdagilar) va past daromadli uy xoʻjaliklari (20 foizdagilar) oʻrtasidagi farqni koʻrsatadi. Tengsizlik koeffitsienti 1988-2004 yillar oraligʻida oshgan va 2008-yilgi Jahon moliyaviy inqiroziga qadar pasaygan. Bu koʻrstakich 2011-yilgacha yana koʻtarilgan va keyin yana pasaya boshlagan. 2013-yilga kelib yuqori daromadli uy xoʻjaliklarining daromadi kam taʻminlangan uy xoʻjaliklariga qaraganda ikki yarim baravar koʻproq boʻlgan[131]. Aholining eng boy 1% qismi mamlakat boyligining 16% qismiga egalik qiladi. Aholning eng boy 5% qismining daromadi esa mamlakat boyligining 38%ini tashkil etadi[132]. Bir vaqtning oʻzida ahollining yarmi xususan nafaqaxoʻrlar hamda pensionerlarning $24 000dan kam daromadga ega[129].

Pensiya[tahrir | manbasini tahrirlash]

Yangi Zelandiya universal pensiya tizimiga ega. Pensiya uchun ayni vaqtda mamlakat hududida yashayotgan faqatgina 65 yosh va bu yoshdan oshgan Yangi Zelandiya fuqarolari yoki uning doimiy rezidentlari ariza topshirish huquqiga ega. Shuningdek ular Yangi Zelandiyada 20 yoshga toʻlganidan beri kamida 10 yil yashagan boʻlishi, shundan kamida 5 yili 50 yoshga toʻlganidan keyinga toʻgʻri kelishi zarur. Ayrim mamlakatlarda maʼlum sabablarga koʻra boʻlgan vaqt Yangi Zelandiya pensiyasiga hisoblanishi ham mumkin. Yangi Zelandiya pensiyasi soliqqa tortiladi, uning stavkasi pensiya oluvchilarning boshqa daromadlariga va toʻlanadigan nafaqa miqdori shaxsning uy sharoitiga bogʻliq. Er-xotin uchun sof soliq miqdori qonun hujjatlaridagi sof oʻrtacha ish haqining 66 foizidan kam boʻlmasligi zarur[133].

Qariyalar sonining ortib borayotganligi sababli pensiya toʻlovlarining hajmi 2008-yildagi 7,3 milliard dollardan 2014-yildagi 10,2 milliard dollargacha koʻtarilgan[134]. 2011-yil holatiga koʻra Yangi Zelandiyada har bir qariya (65 va undan yuqori) uchun ikkita bola toʻgʻri kelgan; 2051-yilga kelib esa qariyalar soni bolalardan 60 foizga koʻp boʻlishi kutilmoqda. 2014-yildan keyingi 10 yil ichida 65 yoshdan oshgan yangi zelandiyaliklar soni qariyb 200 mingga ko‘payishi prognoz qilingan[135].

Bu pensiya tizimi uchun katta muammo tugʻdiradi. Hukumat 1993-2001-yillar oraligʻida pensiyaga chiqish yoshini bosqichma-bosqich 61dan 65ga oshirdi[136]. Oʻsha yili Helen Clark hukumati kelajakda pensiya tizimini moliyalashtirish Yangi Zelandiya pensiya jamgʻarmasini (moliya vaziri Maykl Kallen nomidan "Kullen jamgʻarmasi" deb nomlangan) tashkil etdi. 2014-yil oktyabr holatiga ko‘ra jamg‘arma 27,11 milliard NZ dollarlik aktivlarni boshqaradi, uning 15,9 foizi Yangi Zelandiyaga investitsiya qilingan[137].

2007 yilda xuddi oʻsha hukumat KiwiSaver deb nomlangan yangi shaxsiy jamgʻarma sxemasini joriy qiladi. KiwiSaver asosan odamlarning pensiya jamgʻarmalarini koʻpaytirishni maqsad qilib qoʻyadi, shu jumladan yosh foydalanuvchilar ham undan birinchi uylarini sotib olish uchun depozitni saqlash uchun foydalanishlari mumkin. Sxema ixtiyoriy, ishga asoslangan va “KiwiSaver providers” deb nomlangan xususiy sektor kompaniyalari tomonidan boshqariladi. 2014-yil holatiga koʻra KiwiSaver 2,3 million faol aʼzoga ega boʻlgan ( 65-yoshgacha boʻlgan Yangi Zelandiya aholisining 60,9 foizi). Jamgʻarmaga har yili 4 milliard NZ dollari kelib tushadi va 2007-yildan beri esa jami 19,1 milliard NZ dollar kelib tushgan[138].

Isteʼmol[tahrir | manbasini tahrirlash]

Yangi Zelandiyaliklarning birinchi dunyo davlatlari isteʼmolchilik kayfiyati dunyoning asosiy ishlab chiqaruvchilaridan uzoqda joylashganligi sabab pasaygan boʻlsada ular oʻzlarini birinchi dunyo davlatlari isteʼmolchilaridek koʻradi.

Infratuzilma[tahrir | manbasini tahrirlash]

National Infrastructure Unit of the Treasury maʻlumotlariga koʻra Yangi Zelandiya „…oʻzining infratuzilmasida qiyinchiliklarga uchrashda davom etadi, chunki har qanday turdagi infratuzilma bu uzoq muddatli sarmoyadir va oʻzgarish osonlik va tezlik bilan kelmaydi“[139]. 2020-yili Association of Consulting and Engineering uchun tayyorlangan hisobotda keltirilishicha Yangi Zelandiyada 1980-yillarda boshlangan infratuzilmani past moliyalashtirish siyosati $75 milliardlik (YaIMning taxminan chorak qismi) infratuzilma yetishmovchiligi sabab boʻlgan[140].

Transport[tahrir | manbasini tahrirlash]

Yangi Zelandiyaning transport infratuzilmasi „umumiy yaxshi rivojlangan“[141].

Yoʻl tizimi[tahrir | manbasini tahrirlash]

Yangi Zelandiya avtomagistral yoʻllar tarmogʻi 11,000 kmlik yoʻlni oʻz ichiga olib, uning 5981.3 km qismi Shimoliy Orol va 4924.4 km qismi esa Janubiy Orol hissasiga toʻgʻri keladi. Bu yoʻllar Yangi Zelandiya Transport agentligi tomonidan quriladi va saqlanadi. Yoʻllar uchun mablagʻlar umumiy soliq tushumlaridan hamda yoqilgʻiga solinadigan aksiz bojidan qoblab beriladi. Ogʻir yuk tashuvchilari yoʻldan foydalanish haqini toʻlashlari lozim, shunigdek ushbu foydalanuvchilar uchun davlat yoʻllaridan foydalanishning cheklangan miqdori mavjud. Shu bilan birga mahalliy hokimyatlar tomonidan qurilgan va saqlandigan umumiy uzunligi 83,000 km boʻlgan ichki yoʻllar ham mavjud[142].

Temir yoʻl tizimi[tahrir | manbasini tahrirlash]

Temir yoʻl tizimi KiwiRail davlat korxonasi tomonidan egalik qilinadi va tarmoqda 3,898 kmlik temir yoʻl liniyasi mavjud, relsning eni esa 1,067 mm[141]. Buning 506 km qismi elektrlashtirilgan[143].

Havo yoʻllari[tahrir | manbasini tahrirlash]

Mamlakatda yettita xalqaro va yigirma sakkizta mahalliy aeroportlar bor[141]. 52%lik ulushini davlat egalik[144] Air New Zealand milliy havo tashuvchisidir. Yana bir davlat egalik qiladigan korxona, Airways Yangi Zelandiya, havo yoʻllari nazorati va kommunikatsiyasini taʼminlaydi.

Dengiz portlari[tahrir | manbasini tahrirlash]

Yangi Zelandiyada 14ta dengiz portlari mavjud[141].

Telekommunikatsiya[tahrir | manbasini tahrirlash]

Yangi Zelandiyaning bugungi kundagi telekommunikatsiya tarmogʻi telefon, radio, televideniya, va internetni oʻz ichiga oladi. Raqobatdosh telekommunikatsiya bozori OECD davlatlari ichidagi eng past mobil internet narxlaridan biriga aylanishiga sabab boʻldi[145]. Mis sim va optik tolali kabel tarmoqlari asosan Chorus Limited aksiyadorlik jamiyati tomonidan egalik qilinadi. Chorus oʻzining xizmatlarini chakana internet provayderlariga ulgurji narxlarda sotadi. Mobil internet sektorida uchta operator bor: Spark, One NZ va 2degrees.

Internet[tahrir | manbasini tahrirlash]

Yangi Zelandiyada internetdan yuqori darajada foydalaniladi. Yangi Zelandiyada 1 916 000 ta keng polosali ulanishlar va 65 000 ta dial-up ulanishlari mavjud boʻlib, ulardan 1 595 000 tasi turar-joy va 386 000 tasi biznes yoki hukumatga tegishli[146]. Ulanishlar sonida raqamli aʻzolik liniyasi yetakchilik qiladi va bu telefon liniyasidan ham ustunroqdir[147][148][149].

Energiya[tahrir | manbasini tahrirlash]

1995-2013-yillarda iqtisodiyotning yalpi ichki mahsulot birligiga to‘g‘ri keluvchi energiya sig‘imi 25 foizga kamayadi[150]. Bunga sababchi omil nisbatan kam energiya sarflaydigan xizmat ko‘rsatish sohalarining o‘sishidir[151]. Yangi Zelandiya qayta tiklanadigan energiyaga o‘tish jarayonidagi dunyodagi eng muvaffaqiyatli mamlakatlardan biridir; mamlakat juda yuqorida joylashgan – 156 mamlakat orasida 5-oʻrin – energiya almashinuvidan keyingi geosiyosiy daromadlar va yoʻqotishlar indeksida (GeGaLo Index).[152]

Elektr energiyasi[tahrir | manbasini tahrirlash]

Elektr energiyasi bozori Elektr energetikasi Agentligi (EA) tomonidan boshqariladigan Elektr energetikasi sanoatida ishtirok etish kodeksi bilan tartibga solinadi. Elektr energetikasi asosan gidroenergetika, geotermal energiya va tobora oʻsib borayotgan shamol energiyasi kabi qayta tiklanadigan energiya manbalaridan foydalanadi.

Qayta tiklanadigan energiya manbalarining 83% ulushi[153]Yangi Zelandiyani elektr energiyasi ishlab chiqarish boʻyicha eng barqaror iqtisodiyotlardan biriga aylantiradi[154]; Yangi Zelandiya iqtisodiyoti jami energiya sarfining qayta tiklanadigan manbalardan olinadigan qismi 30 foizini tashkil etadi[155]. Yangi Zelandiya elektr energiyasi ishlab chiqarish va iste’moli o‘rtasidagi geografik nomutanosiblik sababli qiyinchiliklarga duch kelmoqda. Elektr energiyasi ishlab chiqarish Janubiy Orolda yuqori va Shimoliy Orolning markaziy qismida past darajada rivojlangan. Lekin asosiy talab (oʻsishda davom etayotgan) Shimoliy Orolning shimoliy qismida, ayniqsa Oklend viloyatida yuqoridir. Bu elektr energiyasini shimolga elektr simlari orqali yetkaziilish toʻliq quvvatda ishlashini tez-tez talab qiladi.

Suv[tahrir | manbasini tahrirlash]

2021-yil holatiga deyarli hamma suv resurslari (ichimlik suvi, ) mahaliy va hududiy hokimyatlar tomonidan egalik qilinadi. Ushbu resurslarga egalik qiladigan umumiy 67 xil tashkilotlar mavjud[156].

Mahalliy hukumat oldida turgan muammolar ichiga infratuzilma taqchilligini moliyalashtirish va kelgusi 30-40 yil ichida 110 milliard dollarlik yirik sarmoyalarga tayyorgarlik ko‘rish kiradi[157] Ichimlik suvi xavfsizligi boʻyicha qonunchilik talablarini, yomgʻir va oqava suvlarni boshqarish boʻyicha ekologik talablarni bajarilishida ham jiddiy muammolar bor. Iqlim oʻzgarishiga moslashish va aholining oʻsishini taʼminlash kabi qiyinchiliklar bu muammolarni yanada kattalashtiradi.

Uchta suv manbalarini kichik miqdordagi yirik mintaqaviy davlat kommunal xizmatlariga birlashtirishni o‘z ichiga olgan umummilliy davlat dasturi amalga oshirilmoqda[156].

Savdo[tahrir | manbasini tahrirlash]

sectionga aloqador ushbu maqolaning baʼzi qismlari yangilanishga muhtojdir. |

Yangi Zelandiyaning kichik hajmi hamda jahonning yirik bozorlaridan uzoqda joylashganligi global bozorda raqobat qilishda katta qiyinchiliklar yaratadi. 2018-yilda Yangi Zelandiyaning asosiy savdo hamkorlari Xitoy, Avstraliya, Yevropa Ittifoqi, AQSh and Yaponiya edi. Birgalikda Yangi Zelandiyaning bu beshta hamkorlari ikki tomonlama savdoning 66% egalik qilgan[158][159]. 2014-martda mamlakat eksport mahsulotlarining umumiy qiymati birinchi marta $50 milliarddan oshgan va bu qiymat 2001-yilda 30-milliard edi[160]. Yangi Zelandiya Trade and Enterprise (NZTE) shirkati boshqa davlatlarga tovarlar va xizmatlar eksport qilmoqchi boʻlgan korxonalarga strategik maslahatlar va yordamlar taklif etadi.

Savdo shartnomalari[tahrir | manbasini tahrirlash]

1960-yillardan beri Yangi Zelandiya eksport bozorlarini kengaytirish hamda Yangi Zelandiya eksportining jahondagi raqobatdoshligini oshirish uchun koʻplab davlatlar bilan erkin savdo shartnomalarini tuzishni oʻzini maqsadi deb biladi[161]. Savdo toʻsiqlarini kamaytirish bilan bir qatorda, Yangi Zelandiya tuzgan savdo shartnomalari mavjud bozorga kirish huquqlarini saqlab qolishga qaratilgan. Savdo shartnomalari savdoni amalga oshirish qoidalarini belgilaydi va Yangi Zelandiya savdo qilayotgan mamlakatlardagi regulyator va rasmiylarning yaqindan hamkorlikda ishlashini taʼminlayd[161].

Xitoy[tahrir | manbasini tahrirlash]

Xitoy Yangi Zelandiyaning eng katta savdo hamkoridir va Xitoy asosan goʻsht, sut mahsulotlari, va qaragʻay yogʻochini sotib oladi. 2013-yilda Yangi Zelandiya va Xitoy orasidagi savdo NZ$16.8 milliardga teng boʻlgan[159]. Bu jarayon asosan 2008-yildagi xitoy sut mojorosidan soʻng paydo boʻlgan oʻsayotgan talabning natijasidir. Sut mahsulotlariga boʻlgan talabning oʻshandan beri juda ham baland boʻlganligi 2014-yil mart oyigacha boʻlgan 12 oy davomida ushbu mahsulotlarning Xitoyga umumiy eksporti naqd 51%ga oʻsgan[162]. Bu oʻsishni 2008-yil 1-oktyabrda imzolangan Yangi Zelandiya–Xitoy Erkin Savdo Shartnomasi taʼminlagan. Oʻsha yildan beri mamlakatning Xitoyga eksporti uch martdan koʻpga oʻsgan[163].

Avstraliya[tahrir | manbasini tahrirlash]

Xitoy Avstraliyani quvib oʻtishidan oldin Avstraliya Yangi Zelandiyaning ikki tomonlama eng katta savdo hamkori edi va 2013-yilda ikki mamlakat oʻrtasidagi savdoning qiymati NZ$25.6 milliard boʻlgan[159]. Avstraliya va Yangi Zelandiya iqtisodiy va savdo aloqalari „Yaqin Iqtisodiy Hamkorlik“ (CER) shartnomasi doirasida amalga oshirilgan va bu shartnoma tovar va koʻplab xizmatlarning erkin savdosini taʼminlagan. 1990-yildan beri CER 25 million koʻproq odamga ega yagona bozorni yaratgan. Hozirgi kunda Yangi Zelandiya eksportining 19%i Avstraliyaga yoʻnaltirilgan. Eksportning ichiga yengil xom neft, oltin, vino, pishloq va yogʻoch shuningdek keng turdagi sanoat mahsulotlari kirib ketadi.

CER, shuningdek, kasbiy malakalarini oʻzaro tan olish bilan birga, Yangi Zelandiya va Avstraliya fuqarolariga bir-birining hududida erkin yashash va ishlash imkonini beruvchi mehnat bozorini yaratgan. Bu insonlarga bir mamlakatda amalga oshirgan faoliyatni ikkinchi davlatda hech qanday toʻsiqsiz davom ettirishga imkon beradi. Bank tizimi Trans-Tasman Council on Banking Supervision kengashi orqali birgalikda nazorat qilinadi va hozirda Avstraliya va Yangi Zelandiya oʻrtasida tadbirkorlik faoliyatiga oid qonunlarni oʻzaro muvofiqlashtirish boʻyicha maslahatlashuvlar ketmoqda[164].

Yevropa Ittifoqi[tahrir | manbasini tahrirlash]

Yevropa Ittifoqi Yangi Zelandiyaning uchinchi eng yirik savdo hamkoridir. Oʻz mahsulotlarini Yevropa bozoriga yetkazib berish uchun Buyuk Britaniyadan baza sifatida foydalanayotgan Yangi Zelandiya kompaniyalari soni ortib bormoqda[165]. Ammo Osiyodan talabning oʻsishda davom etayotganiga qaramay Yevropa Ittifoqi bilan savdo surati pasayib bormoqda. Yangi Zelandiya eksportining atigi 8%i Yevropa Ittifoqi hissasiga toʻgʻri kelsa-da, importning 12%i ushbu hududdan kirib keladi[164].

2014-yil iyulda Yangi Zelandiya va Yevropa Ittifoqi oʻrtasidagi Munosabatlar va Hamkorlik boʻyicha Sheriklik Shartnomasi (PARC) boʻyicha muzokaralar yakunlandi.[166] Shartnoma savdo va investitsiyalarni yanada erkinlashtirish maqsadida YeI va Yangi Zelandiya oʻrtasidagi savdo-iqtisodiy munosabatlarni qamrab oladi hamda Yevropa Ittifoqining Yangi Zelandiyadagi diplomatik ishtirokini doimiy elchi bilan yaxshilash niyatini eʻtirof etadi[167].

Qoʻshma Shtatlar[tahrir | manbasini tahrirlash]

2013-yilda YeI Qoʻshma Shtatlarni quvib oʻtishidan oldin Yangi Zelandiyaning uchinchi eng yirik savdo hamkori edi va ikki tomonlama savdo hajmi NZ$11.8 milliardga baholangan[159]. Yangi Zelandiyaning Qoʻshma Shtatlarga asosiy eksport tovarlari mol goʻshti, sut mahsulotlari, va qoʻy goʻshtidir. Qoʻshma Shtatlardan import maxsus stanoklar, farmasevtika mahsulotlari, neft va yoqilgʻini oʻz ichiga oladi. Savdoga qoʻshimcha holda ikki mamlakat oʻrtasida yuqori darajadagi korporativ va individual sarmoyalar mavjud hamda Qoʻshma Shtatlar Yangi Zelandiyaga kelayotgan sayyohlarning asosiy manbasidir. 2012-yil mart holatiga Qoʻshma Shtatlar Yangi Zelandiyaga umumiy qiymati $44 milliardlik sarmoyalar kiritgan[168]. Koʻplab Qoʻshma Shtatlar kompaniyalarining Yangi Zelandiyada shoʻba korxonalari mavjud. Koʻpchiligi mahalliy agentliklar orqali, baʻzilari esa qoʻshma korxonalar orqali faoliyat yuritadi. United States Chamber of Commerce Yangi Zelandiyada faol hisoblanib, asosiy ofisi Oklendda, filiali esa Vellingtonda joylashgan.

Tashqi Ishlar Vazirligiga koʻra Yangi Zelandiya va Qoʻshma Shtatlar umumiy tarix, qadriyatlar, va manfaatlarga asoslangan chuqur va azaliy doʻstlik hamda erkin, xavfsiz, demokratik, va farovon dunyo yaratish uchun umumiy maqsadga ega[169]. Ammo ushbu umumiy tarix ikki davlat oʻrtasida erkin savdo shartnomasi imzolanishiga olib kelmagan[170].

Yaponiya va boshqa Osiyo bozorlari[tahrir | manbasini tahrirlash]

Yaponiya Yangi Zelandiya beshinchi eng katta savdo hamkoridir. XXI asrda tez rivojlanib borayotgan Osiyo bozorlari Yangi Zelandiya ekportiga nisbatan talabni oshirib yubormoqda. Shuningdek Yangi Zelandiya Tayvan, Gong Kong, Malayziya, Indoneziya, Singapur, Tailand, Hindiston va Filippin bilan ham savdo qiladi va umumiy eksportning taxminan 16%i shu davlatlar hissasiga toʻgʻri keladi[164]. 2000-yilda Yangi Zelandiya Singapur bian erkin savdo shartnomasi tuzadi, 2005-yilda esa shartnomaga Chili va Bruney ham qoʻshiladi va shartnoma hozirda P4 shartnomasi nomi bilan tanilgan.

Tinch okeani orollari bilan munosabatlar[tahrir | manbasini tahrirlash]

Tinch okeani hududidagi orollar Yangi Zelandiyaning oltinchi eng katta bozoridir va yildan yilga oʻsib bormoqda. 2011-yilda Tinch Okeani Orollariga eksport hajmi $1.5 milliarddan oshadi va bu koʻrsatkich oʻtgan yilga nisbatan 12%ga oʻsgan. Ushbu hududdagi eng katta individual bozor Fijinikidir va keuingi oʻrinlarda Papua Yangi Gvineya, Fransuz Polineziyasi va Yangi Kaledoniya turadi. Orollarga eksport qilingan tovarlarga qayta ishlangan neft, qurilish materiallari, dori-darmon, qoʻy goʻshti, sut, sariyogʻ, meva va sabzavotlar kiradi[171]. Shuningdek Yangi Zelandiya Tinch okeani orollariga mudofaa va hududiy xavfsizlik yoʻnalishlarida, hamda atrof-muhitni muhofaza qilish va baliqchilik sohalarida yordam beradi.

Hududlarining kichik hajmi Tinch Okeani orollari yillik siklonlarga dunyodagi eng zaif hududlar hisoblanadi. Tabiiy ofatlarning ijtimoiy va iqtisodiy sohalarga salbiy taʻsiri bir necha yillarga choʻziladi. 1992-yildan beri Yangi Zelandiya Avstraliya va Fransiya bilan hamkorlikda Tinch Okeanidagi tabiiy ofatlar oqibatlariga qarshi kurashadi. Yangi Zelandiya favqulodda vaziyatlar uchun avariya vositalari va transport vositalari bilan ta’minlaydi, yo‘l va uy-joy qurilishi uchun mablag‘ ajratadi hamda zarar ko‘rgan hududlarga mutaxassislarni jo‘natadi[172]

Tashqi Ishlar va Savdo vazirligi orqali Yangi Zelandiya rivojlanmagan mamlakatlarini davomiy iqtisodiy oʻsishni saqlash uchun xalqaro yordam va rivojlanish fondlari bilan taʼminlaydi. Yangi Zelandiya Yordam Dasturi Tinch Okeanida rivojlanishni taʼminlash uchun yiliga taxminan $550 million sarflaydi. $550 million mablagʻ Yangi Zelandiya Yalpi Milliy Mahsuloti(YMM)ning 0.26%ini tashkil etadi[173].

Chet-el Sarmoyasi[tahrir | manbasini tahrirlash]

Yangi Zelandiya chet-el sarmoyalarini ragʻbatlanitiradi va sarmoyalar Overseas Investment Office tomonidan nazorat qilinadi. 2014-yilda chet-eldan toʻgʻridan-toʻgʻri sarmoyalar hajmi umumiy NZ$107.69 milliardni tashkil etgan[20]. 1989- va 2013-yillar oraligʻida chet-el sarmoyalari 1,000%dan ortiqqa oʻsib NZ$9.7 milliarddan NZ$101.4 milliardgacha yetgan[174]. 1989- va 2007-yillar davomida chet-elliklarning Yangi Zelandiyaning aksiyalar bozoridagi ulushi 19%dan 41%cha oʻsdi, ammo bu koʻrsatkich keyinchalik 33%ga tushib ketgan.

2007-yilda qishloq xoʻjaligida foydali yerlarning taxminan 7%i chet-elliklar tomonidan egalik qilingan[33]. 2011-yilda iqtisodchi Bill Rosenberg fikricha oʻrmonchilik yerlarini qoʻshib hisoblaganda ushbu koʻrsatkich 9%ni tashkil etgan[175]. 2013-yilning martida moliyaviy sektor NZ$101.4 milliard dollarga baholangan va u oʻsha paytda chet-elliklarning Yangi Zelandiyada eng katta ulushi bor sektordir. Mamlakatdagi NZ$39.3 milliardga baholanadigan „katta toʻrtlik“ banklari avstraliyaliklar tomonidan egalik qilinadi[174].

Natijasi[tahrir | manbasini tahrirlash]

1997- va 2007-yillar davomida chet-ellik sarmoyadorlar NZ$50.3 milliard foyda qildi va foydaning 68%i chetga chiqib ketgan. Campaign Against Foreign Control of Aotearoa (CAFCA) aytishicha bu jarayon iqtisodiyotga salbiy taʻsir koʻrsatgan va ularning taʻkidlashicha chet-el sarmoyadorlari Yangi Zelandiya kompaniyalarini sotib olganda ishchilar sonini qisqartirishga hamda maoshlarni qisqartirishga moyil boʻladi[33]. Yana qoʻshimcha qilnishicha chet-elliklarning Yangi Zelandiyada kompaniyalarga egalik qilishi mamlakat tashqi qarzini kamaytirishga hech qanday yordam bermagan boʻlishi. 1984-yilda xususiy va davlatning tashqi qarzi NZ$16 milliard (2013-yil mart holatiga bu NZ$50 milliardga teng)ga teng edi va oʻsha paytdagi Yangi Zelandiya YaIMning yarmidan kamini tashkil etgan. 2013-yil martgacha mamlakatning umumiy tashqi qarzi NZ$251 milliard boʻlib, va bu koʻrsatkich Yangi Zelandiya YaIMining 100%dan koʻprogʻini tashkil etgan[174].

Maʼlumotlar[tahrir | manbasini tahrirlash]

Quyidagi jadval 1980–2020-yillardagi asosiy iqtisodiy koʻrsatkichlarni tasvirlaydi (jumladan 2021-2026-yillar uchun prognoz koʻrsatadi). Inflatsiya 2%dan kam boʻlsa yashilda koʻrsatilgan[176].

| Yil | YaIM (mlrd. AQSh$ XQP) | Kishi boshiga YaIM (AQSh$ XQP) | YaIM (mlrd. AQSh$ nominal) | Kishi boshiga YaIM (AQSh$ nominal) | YaIM oʻsishi (real) | Inflatsiya darajasi (%) | Ishsizlik (%) | Davlat qarzi YaIM nisbatida (%) |

|---|---|---|---|---|---|---|---|---|

| 1980 | 28.5 | 9,177.3 | 22.5 | 7,246.9 | ▲17.1% | 4.0% | n/a | |

| 1981 | ▲15.5% | ▼3.9% | n/a | |||||

| 1982 | ▲16.1% | ▲4.4% | n/a | |||||

| 1983 | ▲7.4% | ▲6.2% | n/a | |||||

| 1984 | ▲6.1% | ▲7.2% | n/a | |||||

| 1985 | ▲15.4% | ▼3.9% | 64.2% | |||||

| 1986 | ▲13.2% | ▲4.2% | ▲68.6% | |||||

| 1987 | ▲15.8% | ▲4.2% | ▼63.0% | |||||

| 1988 | ▲6.4% | ▲5.8% | ▼54.8% | |||||

| 1989 | ▲5.7% | ▲7.3% | ▲55.0% | |||||

| 1990 | ▬0.0% | ▲6.1% | ▲8.0% | ▲55.5% | ||||

| 1991 | ▲2.6% | ▲10.6% | ▲58.0% | |||||

| 1992 | ▲10.7% | ▲58.7% | ||||||

| 1993 | ▼9.8% | ▼54.6% | ||||||

| 1994 | ▼8.4% | ▼48.9% | ||||||

| 1995 | ▲3.8% | ▼6.5% | ▼43.5% | |||||

| 1996 | ▲2.3% | ▼6.3% | ▼37.3% | |||||

| 1997 | ▲6.9% | ▼34.6% | ||||||

| 1998 | ▲7.7% | ▼34.5% | ||||||

| 1999 | ▼7.1% | ▼32.0% | ||||||

| 2000 | ▲2.6% | ▼6.2% | ▼30.0% | |||||

| 2001 | ▲2.6% | ▼5.5% | ▼28.2% | |||||

| 2002 | ▲2.7% | ▼5.3% | ▼26.4% | |||||

| 2003 | ▼4.8% | ▼24.7% | ||||||

| 2004 | ▲2.3% | ▼4.0% | ▼22.5% | |||||

| 2005 | ▲3.0% | ▼3.8% | ▼20.8% | |||||

| 2006 | ▲3.4% | ▲3.9% | ▼18.4% | |||||

| 2007 | ▲2.4% | ▼3.6% | ▼16.3% | |||||

| 2008 | ▲4.0% | ▲4.0% | ▲19.0% | |||||

| 2009 | ▲2.1% | ▲5.9% | ▲24.3% | |||||

| 2010 | ▲2.3% | ▲6.2% | ▲29.7% | |||||

| 2011 | ▲4.0% | ▼6.1% | ▲34.7% | |||||

| 2012 | ▲6.5% | ▲35.7% | ||||||

| 2013 | ▼5.8% | ▼34.6% | ||||||

| 2014 | ▼5.4% | ▼34.2% | ||||||

| 2015 | ▬5.4% | ▬34.2% | ||||||

| 2016 | ▼5.2% | ▼33.4% | ||||||

| 2017 | ▼4.8% | ▼31.1% | ||||||

| 2018 | ▼4.3% | ▼28.0% | ||||||

| 2019 | ▼4.2% | ▲32.0% | ||||||

| 2020 | ▲4.6% | ▲43.6% | ||||||

| 2021 | ▲3.0% | ▼4.3% | ▲52.0% | |||||

| 2022 | ▲2.2% | ▲4.4% | ▲56.9% | |||||

| 2023 | ▲4.7% | ▲58.5% | ||||||

| 2024 | ▲4.9% | ▲59.0% | ||||||

| 2025 | ▼4.4% | ▼57.8% | ||||||

| 2026 | ▲4.5% | ▼55.3% |

- Sanoat ishlab chiqarishi oʻsishi darajasi

- 5.9% (2004) / 1.5% (2007)

- Xoʻjaliklar daromadi yoki isteʼmolidagi foiz ulushi

- Eng past 10%: 0.3% (1991)

- Eng baland 10%: 29.8% (1991)

- Agriculture – products

- Bugʻdoy, arpa, kartoshka, baklagiller, mevalar, sabzavotlar; jun, mol goʻshti, sut mahsulotlari; baliq

- Export – mollari

- Sut mahsulotlari, goʻsht, yogʻoch va yogʻoch mahsulotlari, baliq, mashinasozlik

- Import – mollari

- Stanoklar va uskunalar, transport vositalari va samolyotlar, neft, elektronika, toʻqimachilik, plastmassa

- Elektr energiyasi

- isteʼmol: 34.88 TWh (2001) / 37.39 TWh (2006)

- Ishlab chiqarish: 38.39 TWh (2004) / 42.06 TWh (2006)

- Exports: 0 kWh (2006)

- Imports: 0 kWh (2006)

- Suv: 60% (2020)

- Geotermal: 17% (2020)

- Shamol: 5% (2020)

- Yoqilgʻi: 17% (2020)

- Yadro: 0% (2020)

- Boshqalar: 3.4% (2010)

- Neft

- Ishlab chiqarish: 42,160 barrel (6,703 m3) 2001 / 25,880 barrel (4,115 m3) 2006

- isteʼmol: 132,700 barrel (21,100 m3) 2001 / 156,000 barrel (24,800 m3) 2006

- Export: 30,220 barrel (4,805 m3) 2001 / 15,720 barrel (2,499 m3) 2004

- Import: 119,700 barrel (19,030 m3) 2001 / 140,900 barrel (22,400 m3) 2004

- Aniqlangan zaxiralar: 89.62 million barrels (14,248,000 m3) 2002-yil yanvar

- Valyuta kursi

- 1 AQSh$ uchun Yangi Zelandiya dollari (NZ$) – 1.4771 (2016), 1.2652 (2012), 1.3869 (2005), 1.5248 (2004), 1.9071 (2003), 2.1622 (2002), 2.3788 (2001), 2.2012 (2000), 1.8886 (1999), 1.8632 (1998), 1.5083 (1997), 1.4543 (1996), 1.5235 (1995)

Yana qarang[tahrir | manbasini tahrirlash]

- Yangi Zelandiyada qishloq xoʻjaligi

- Okeaniya iqtisodiyoti

- Yangi Zelandiya energetikasi

- Yangi Zelandiya bank sektori tarixi

- Yangi Zelandiya tashqi savdosi

- Avstraliya va Yangi Zelandiya uy xoʻjaliklarining oʻrtacha daromadi

- Biznes, Innovatsiya va Bandlik vazirligi

- Yangi Zelandiya Zaxira Banki

- Yangi Zelandiyada kommunikatsiya

Manbalar[tahrir | manbasini tahrirlash]

- ↑ „Year End Financial Statements“. NZ Treasury. Qaraldi: 2017-yil 5-mart.

- ↑ „World Economic Outlook Database, April 2019“. IMF.org. International Monetary Fund. Qaraldi: 2023-yil 25-oktyabr.

- ↑ „World Bank Country and Lending Groups“. datahelpdesk.worldbank.org. World Bank. Qaraldi: 2019-yil 29-sentyabr.

- ↑ „Subnational population estimates (RC, SA2), by age and sex, at 30 June 1996-2023 (2023 boundaries)".“. Statistics New Zealand. Qaraldi: 2017-yil 5-mart.

- ↑ 5,0 5,1 5,2 5,3 „Report for Selected Countries and Subjects: April 2023“. imf.org. International Monetary Fund.

- ↑ 6,0 6,1 6,2 „The outlook is uncertain again amid financial sector turmoil, high inflation, ongoing effects of Russia's invasion of Ukraine, and three years of COVID“. International Monetary Fund (2023-yil 11-aprel).

- ↑ „New Zealand Economic and Financial Overview“ 19–23. New Zealand Treasury (2012). 2017-yil 4-mayda asl nusxadan arxivlangan. Qaraldi: 2017-yil 17-mart.

- ↑ „Annual inflation at 7.3 percent, 32-year high“. Statistics New Zealand (2022-yil 18-iyul).

- ↑ „Relative poverty rate at 50% of the median household income in OECD countries“.

- ↑ „Human Development Index (HDI)“. hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Qaraldi: 2022-yil 5-oktyabr.

- ↑ Nations, United. Inequality-adjusted HDI (IHDI). UNDP. http://hdr.undp.org/en/indicators/138806. Qaraldi: 5 October 2022.Yangi Zelandiya iqtisodiyoti]]

- ↑ 12,0 12,1 12,2 12,3 12,4 „Labour market statistics: June 2022 quarter | Stats NZ“. www.stats.govt.nz. Stats NZ. Qaraldi: 2022-yil 3-avgust.

- ↑ 13,0 13,1 13,2 13,3 13,4 13,5 „The World Factbook“. CIA.gov. Central Intelligence Agency. Qaraldi: 2019-yil 23-oktyabr.

- ↑ „Home“.

- ↑ „Taxing Wages 2023: Indexation of Labour Taxation and Benefits in OECD Countries | READ online“.

- ↑ „Home“.

- ↑ „Ease of Doing Business in New Zealand“. Doingbusiness.org. Qaraldi: 2017-yil 24-noyabr.

- ↑ 18,0 18,1 18,2 18,3 „Overseas merchandise trade: June 2023“. Stats NZ. Qaraldi: 2023-yil 27-oktyabr.

- ↑ „Balance of Payments and International Investment Position – M7“. Statistics New Zealand. Reserve Bank of New Zealand (2018-yil 19-dekabr). Qaraldi: 2019-yil 23-fevral.

- ↑ 20,0 20,1 20,2 „Financial Statements of the Government of New Zealand for the eight months ended 28 February 2018“. New Zealand Treasury (2018-yil 8-aprel). Qaraldi: 2019-yil 17-fevral.

- ↑ „New Zealand Foreign Exchange Reserves, 2005–2023 | CEIC Data“. www.ceicdata.com. Qaraldi: 2023-yil 8-avgust.

- ↑ Hall, Peter A.; Soskice, David. Varieties of Capitalism: The Institutional Foundations of Comparative Advantage. Oxford University Press, 2001 — 570 bet. ISBN 978-0191647703.

- ↑ 23,0 23,1 23,2 „New Zealand in Profile 2014: Economy“. Statistics New Zealand (2011-yil mart). Qaraldi: 2014-yil 9-dekabr.

- ↑ Minerals, New Zealand Petroleum and „Mineral resources potential“ (en-NZ). New Zealand Petroleum and Minerals. Qaraldi: 2024-yil 9-fevral.

- ↑ „NZ Tech – About the Tech Sector“. Qaraldi: 2020-yil 7-yanvar.

- ↑ „1. NZX Annual Report 2022 (including audited financial statements)“. NZX (2023-yil 23-fevral). Qaraldi: 2023-yil 26-oktyabr.

- ↑ „Triennial Central Bank Survey, April 2013“. Triennial Central Bank Survey. Bank for International Settlements. Qaraldi: 2014-yil 25-mart. [pg.10 of PDF]

- ↑ 28,0 28,1 28,2 "Early pastoral economy". Te Ara: The Encyclopedia of New Zealand. p. 4. http://www.teara.govt.nz/en/economic-history/page-4.

- ↑ 29,0 29,1 New Zealand Historical Atlas McKinnon, Malcolm: . David Bateman, 1997.

- ↑ 30,0 30,1 „The introduction of refrigeration“. NZ International Business Forum. 2015-yil 13-mayda asl nusxadan arxivlangan. Qaraldi: 2014-yil 19-oktyabr.

- ↑ Drew, Aaron. "New Zealand's productivity performance and prospects". Bulletin 70 (1). http://www.rbnz.govt.nz/research_and_publications/reserve_bank_bulletin/2007/2007mar70_1drew.pdf. Qaraldi: 10 February 2008.Yangi Zelandiya iqtisodiyoti]]

- ↑ Evans, Lewis; Grimes, Arthur; Wilkinson, Bryce (December 1996). "Economic Reform in New Zealand 1984–95: The Pursuit of Efficiency". Journal of Economic Literature 34 (4): 1856–902. https://ideas.repec.org/a/aea/jeclit/v34y1996i4p1856-1902.html. Qaraldi: 4 October 2012.Yangi Zelandiya iqtisodiyoti]]

- ↑ 33,0 33,1 33,2 33,3 McCarten, Matt. „Foreign owners muscle in as New Zealand sells off all its assets“. The New Zealand Herald (2007-yil 14-yanvar).

- ↑ „New Zealand rated most business-friendly“. International Herald Tribune (2005-yil 14-sentyabr).

- ↑ 35,0 35,1 35,2 "External diversification after 1966". Te Ara: The Encyclopedia of New Zealand. p. 10. http://www.teara.govt.nz/en/economic-history/page-10.<!--->

- ↑ 36,0 36,1 "Early Māori economies". Te Ara: The Encyclopedia of New Zealand. p. 2. http://www.teara.govt.nz/en/economic-history/page-2.<!--->

- ↑ 37,0 37,1 37,2 King, Michael. The Penguin History of New Zealand. Penguin Books, 2003. ISBN 978-0-14-301867-4.

- ↑ "First European economies". Te Ara: The Encyclopedia of New Zealand. http://www.teara.govt.nz/en/economic-history/page-3.<!--->

- ↑ Warwick Robert Armstrong. "Vogel, Sir Julius, K.C.M.G". Te Ara: The Encyclopedia of New Zealand. http://www.teara.govt.nz/en/1966/vogel-sir-julius-kcmg.

- ↑ "Boom and bust, 1870–1895". Te Ara: The Encyclopedia of New Zealand. p. 5. http://www.teara.govt.nz/en/economic-history/page-5.<!--->

- ↑ 41,0 41,1 "Refrigeration, dairying and the Liberal boom". Te Ara: The Encyclopedia of New Zealand. http://www.teara.govt.nz/en/economic-history/page-6.

- ↑ 42,0 42,1 Baten, Jörg. A History of the Global Economy. From 1500 to the Present.. Cambridge University Press, 2016 — 287 bet. ISBN 978-1107507180.

- ↑ "Inter-war years and depression". Te Ara: The Encyclopedia of New Zealand. http://www.teara.govt.nz/en/economic-history/page-7.

- ↑ 44,0 44,1 Liu, Shirley „The history of the New Zealand dollar“. finder.com US (2015-yil 13-oktyabr). 2019-yil 10-avgustda asl nusxadan arxivlangan. Qaraldi: 2019-yil 11-avgust.

- ↑ 45,0 45,1 „New Zealand's trade history“. New Zealand International Business Forum. 2015-yil 13-mayda asl nusxadan arxivlangan. Qaraldi: 2014-yil 19-oktyabr.

- ↑ "NAFTA signed". Te Ara: The Encyclopedia of New Zealand. http://www.nzhistory.net.nz/culture/the-1960s/1965.<!--->

- ↑ 47,0 47,1 "Britain, New Zealand and the EU after 1940". Te Ara: The Encyclopedia of New Zealand. http://www.teara.govt.nz/en/international-economic-relations/page-4.<!--->

- ↑ „New Zealand's Export Markets year ended June 2000 (provisional)“. Statistics New Zealand (2000-yil iyun). 2010-yil 15-mayda asl nusxadan arxivlangan. Qaraldi: 2008-yil 15-iyun.

- ↑ 49,0 49,1 49,2 „Inflation“. Reserve Bank of New Zealand. 2014-yil 7-dekabrda asl nusxadan arxivlangan. Qaraldi: 2014-yil 8-dekabr.

- ↑ 50,0 50,1 „In the shadow of Think Big“. The New Zealand Herald (2011-yil 31-yanvar).

- ↑ „Introduction“. New Zealand Aluminium Smelter Limited. Qaraldi: 2014-yil 8-dekabr.

- ↑ „The 1980s“.

- ↑ 53,0 53,1 „20 years of a floating New Zealand dollar“. Reserve Bank of New Zealand. 2014-yil 25-oktyabrda asl nusxadan arxivlangan. Qaraldi: 2014-yil 25-oktyabr.

- ↑ Russell 1996, s. 119.

- ↑ „Share Price Index, 1987–1998“. 2010-yil 25-mayda asl nusxadan arxivlangan.

- ↑ „Commercial Framework: Stock exchange, New Zealand Official Yearbook 2000“. Statistics New Zealand. 2016-yil 4-martda asl nusxadan arxivlangan. Qaraldi: 2014-yil 8-dekabr.

- ↑ 57,0 57,1 57,2 57,3 Kelsey, Jane. „Life in the Economic Test-Tube: New Zealand 'experiment' a colossal failure“ (1999-yil 9-iyul). 2016-yil 2-noyabrda asl nusxadan arxivlangan. Qaraldi: 2012-yil 26-yanvar.

- ↑ OECD. „LFS by sex and age – indicators“. Stats.oecd.org (1988-yil 28-yanvar). Qaraldi: 2018-yil 5-sentyabr.

- ↑ „Reserve Bank statistics – Employment“. Reserve Bank of New Zealand. 2016-yil 22-yanvarda asl nusxadan arxivlangan. Qaraldi: 2014-yil 8-dekabr.

- ↑ 60,0 60,1 „New Zealand as it might have been: From Ruthanasia to President Bolger“. The New Zealand Herald (2007-yil 12-yanvar). Qaraldi: 2014-yil 8-dekabr.

- ↑ Ministry for Culture and Heritage „The state steps in and out – housing in New Zealand“. New Zealand history online (2012-yil 29-fevral). Qaraldi: 2012-yil 9-iyul.

- ↑ Dobbin, Murray. „New Zealand's Vaunted Privatization Push Devastated The Country, Rather Than Saving It“. The National Post (Canada) (2000-yil 15-avgust). 2013-yil 24-martda asl nusxadan arxivlangan.

- ↑ "Government and market liberalisation". Te Ara: The Encyclopedia of New Zealand. p. 11. http://www.teara.govt.nz/en/economic-history/page-11.

- ↑ OECD „1. Gross domestic product (GDP)“. stats.oecd.org.

- ↑ „New Zealand Unemployment Data Set“. OECD.

- ↑ „Survey ranks NZ in top six for economic freedom“. The New Zealand Herald (2008-yil 16-yanvar).

- ↑ Rudman, Brian. „Government must plug those leaks“. The New Zealand Herald (2009-yil 18-sentyabr).

- ↑ Weshah Razzak. „New Zealand Labour Market Dynamics: Pre- and Post-global Financial Crisis“. New Zealand Treasury (2014-yil fevral). 2015-yil 25-yanvarda asl nusxadan arxivlangan. Qaraldi: 2014-yil 13-dekabr.

- ↑ Joyce, Steven „Unemployment figure lowest in seven years“. beehive.govt.nz. New Zealand Government (2016-yil 3-fevral).

- ↑ 70,0 70,1 70,2 70,3 70,4 70,5 „Recent Economic Performance and Outlook“. New Zealand Treasury (2014). 2015-yil 18-yanvarda asl nusxadan arxivlangan. Qaraldi: 2014-yil 26-dekabr.

- ↑ „The Treasury: Learning from managing the Crown Retail Deposit Guarantee Scheme“. Controller and Auditor-General of New Zealand.

- ↑ Yahanpath, Noel; Cavanagh, John (2011). "Causes of New Zealand Finance Company Collapses: A Brief Review". Social Science Research Network.

- ↑ „Deposit guarantee scheme introduced“. Reserve Bank of New Zealand. 2008-yil 14-oktyabrda asl nusxadan arxivlangan.

- ↑ „Deep freeze list – Finance industry failures“. Interest.co.nz.

- ↑ „Fran O'Sullivan: Treasury must front up over role in SCF debacle“. The New Zealand Herald (2014-yil 18-oktyabr).

- ↑ Krause, Nick; Mace, William. „Nathans Finance directors jailed“. Stuff.co.nz (2011-yil 2-sentyabr). Qaraldi: 2017-yil 22-yanvar.

- ↑ Fletcher, Hamish. „Capital + Merchant directors jailed“. The New Zealand Herald (2012-yil 31-avgust). Qaraldi: 2017-yil 22-yanvar.

- ↑ „Prison for Bridgecorp director“. Stuff.co.nz (2012-yil 17-aprel). Qaraldi: 2017-yil 22-yanvar.

- ↑ „Remorseless director Rod Petricevic jailed“. Stuff.co.nz (2012-yil 26-aprel). Qaraldi: 2017-yil 22-yanvar.

- ↑ „David Ross gets 10 years,10 months jail“. The New Zealand Herald (2013-yil 15-noyabr). Qaraldi: 2017-yil 22-yanvar.

- ↑ „NZ economy could hit the rocks – economists“. Stuff (2014-yil 25-avgust).

- ↑ „New Zealand 2014's 'rock star' economy“. Stuff (2014-yil 7-yanvar).

- ↑ „Rock star economy or one hit wonder?“. New Zealand Productivity Commission (2014-yil 17-aprel). 2019-yil 23-yanvarda asl nusxadan arxivlangan. Qaraldi: 2014-yil 26-dekabr.

- ↑ „NZ's 'rock star' status dims“. The New Zealand Herald (2014-yil 19-avgust).

- ↑ Niko Kloeten.. „'Rock star' economy to play on“. Stuff (2014-yil 3-dekabr). Qaraldi: 2015-yil 21-yanvar.

- ↑ „How New Zealand's rich-poor divide killed its egalitarian paradise“. The Guardian (2014-yil 12-dekabr). Qaraldi: 2015-yil 21-yanvar.

- ↑ „Covid-19: GDP results show NZ officially in first recession in a decade“. Radio New Zealand (2020-yil 17-sentyabr). 2020-yil 17-sentyabrda asl nusxadan arxivlangan. Qaraldi: 2020-yil 17-sentyabr.